Beginner’s Guide to Investing in Best High-Yield Dividend Stocks

Advertisement

Investing in high-yield dividend stocks is a smart way to grow your income over time. These stocks pay regular dividends, providing a steady stream of cash while potentially increasing in value. They are a great choice for anyone looking for reliable income, whether you’re saving for retirement or building wealth. In this guide, we’ll explore some of the best high-yield dividend stocks to help you make the most of your investments.

What are High-Yield Dividend Stocks?

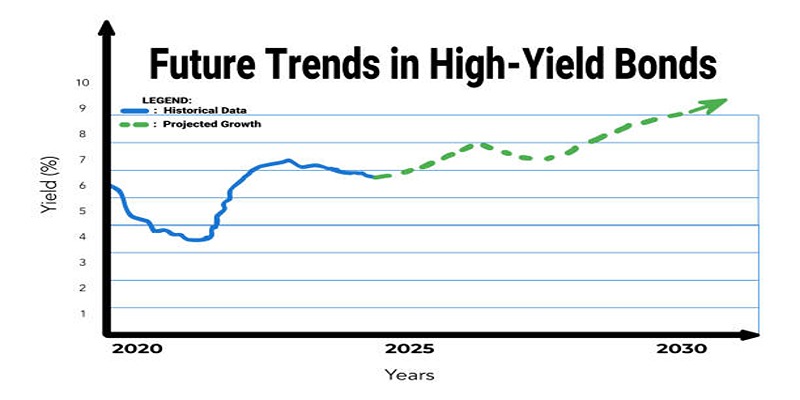

When businesses distribute high dividend yields to shareholders they belong to the category of high-yield dividend stocks. The annual payout amount from stock dividends creates a dividend yield through division of its current stock price. The dividend yield calculation would be 4% when a stock pays $2 in dividends at its $50 current market value. The dividend yield of high-yield stocks typically exceeds 4% in value.

A company distributes regular shareholder payments through dividing a percentage of its profits. Companies with solid financial resources and steady earnings uptrend pay larger dividends which creates strong appeal for investors seeking dependable returns.

Why Invest in High-Yield Dividend Stocks?

Investing in stocks which generate high dividend payouts brings multiple advantageous aspects to investors as follows:

- Regular income stream enables investors to receive steady payments through dividend distributions.

- An investor receives passive dividends which require minimal active involvement unlike traditional employment. Receiving income stream becomes possible for you when you concentrate on different parts of life.

- Potential for Capital Appreciation: In addition to regular dividends, high-yield dividend stocks also have the potential for capital appreciation over time. As the company grows and its stock price increases, so does the value of your investment.

- Diversification: Investing in high-yield dividend stocks can help diversify your portfolio, reducing overall risk. This is because dividends are not dependent on stock price movements and can provide a steady source of income even during market downturns.

- Inflation Protection: Dividends have historically increased at a rate higher than inflation, providing a hedge against rising prices.

How to Choose the Best High-Yield Dividend Stocks

When it comes to investing in high-yield dividend stocks, here are some factors to consider:

- Dividend Sustainability: Look for companies with strong financials and consistent earnings growth that can support their dividend payments.

- Dividend Growth: Investing in companies that have a track record of increasing dividends over time can provide a growing source of income.

- Sector Diversity: Diversifying your investments across different sectors can help mitigate risk. Consider investing in high-yield dividend stocks from various industries.

- Valuation: Look for undervalued stocks that have potential for capital appreciation while still providing a decent yield.

Top High-Yield Dividend Stocks to Consider

Here are some of the best high-yield dividend stocks to consider for your portfolio:

1. Verizon Communications (VZ)

Verizon Communications is a leading telecommunications company that has been a consistent dividend payer for years. With a strong market position and steady cash flow, Verizon offers investors a high dividend yield. The company’s focus on expanding 5G technology and maintaining its subscriber base makes it an attractive option for those seeking reliable income.

2. The Coca-Cola Company (KO)

The Coca-Cola Company has long been considered a reliable choice for dividend investors. Known for its strong global brand, Coca-Cola boasts a consistent history of paying and increasing dividends, earning it the status of a Dividend Aristocrat. With its diversified portfolio of beverages and a wide global market presence, Coca-Cola provides both stability and growth potential. The company’s dividend yield typically remains attractive, making it a solid pick for investors seeking steady income and long-term value.

3. ExxonMobil (XOM)

ExxonMobil is a leader in the energy sector and another excellent choice for high-yield dividend stocks. Despite fluctuations in the oil and gas industry, ExxonMobil has demonstrated resilience and a commitment to rewarding its shareholders. The company has maintained a strong dividend payment history, even during challenging market conditions. Its significant position in the energy markets and strategic investments in renewable energy initiatives add to its appeal as a high-yield dividend stock.

4. Procter & Gamble (PG)

Procter & Gamble is renowned for its household and personal care products, making it a staple in the consumer goods sector. This stability has allowed the company to pay regular dividends for decades, with a consistent pattern of annual increases. The diversification of its product line and its strong consumer base make Procter & Gamble a dependable option for high-yield dividend investors.

5. Realty Income Corporation (O)

Specializing in commercial real estate, it pays dividends on a monthly basis, providing an even steadier stream of income. Its portfolio includes high-quality tenants across various industries, adding diversification and stability to its business model. With a strong dividend yield and a proven track record of consistent payouts, Realty Income is an attractive option for those prioritizing passive income.

6. AT&T Inc (T)

AT&T is another telecommunications company that has been a reliable dividend payer for many years. It boasts a strong market position and consistent earnings growth, making it well-positioned to sustain its high dividend yield. In addition to traditional telecommunication services, the company has also expanded into streaming and media with its acquisition of WarnerMedia. This diversification adds potential for future growth, making AT&T an appealing choice for high-yield dividend investors.

Johnson & Johnson (JNJ)

Johnson & Johnson is a leading healthcare company that has been paying dividends for over 50 years. Its diversified portfolio of products, including pharmaceuticals, medical devices, and consumer health goods, provides stability and potential for growth. The company also has a strong history of increasing dividends, making it an attractive option for investors seeking both income and long-term value.

Conclusion

Investing in high-yield dividend stocks can offer many benefits to investors looking for passive income and steady returns. By considering factors such as dividend sustainability, growth potential, sector diversity, and valuation when choosing which stocks to invest in, you can build a well-rounded portfolio that can provide consistent income for years to come. With the right approach and a diverse selection of high-yield dividend stocks, you can reduce overall risk and potentially see significant returns on your investment.

On this page

What are High-Yield Dividend Stocks? Why Invest in High-Yield Dividend Stocks? How to Choose the Best High-Yield Dividend Stocks Top High-Yield Dividend Stocks to Consider 1. Verizon Communications (VZ) 2. The Coca-Cola Company (KO) 3. ExxonMobil (XOM) 4. Procter & Gamble (PG) 5. Realty Income Corporation (O) 6. AT&T Inc (T) Johnson & Johnson (JNJ) ConclusionAdvertisement